It’s Getting More Affordable To Buy a Home

There’s finally a little good news for anyone who’s been priced out or sitting on the sidelines.

Buying a home is getting more affordable.

Monthly payments have started to come down, and the squeeze buyers have been feeling for the past few years is slowly loosening. Now, that doesn’t mean everyone can suddenly afford a home, but with how tough the market’s been, the improvement we’re seeing matters.

Affordability Is Finally Moving in the Right Direction

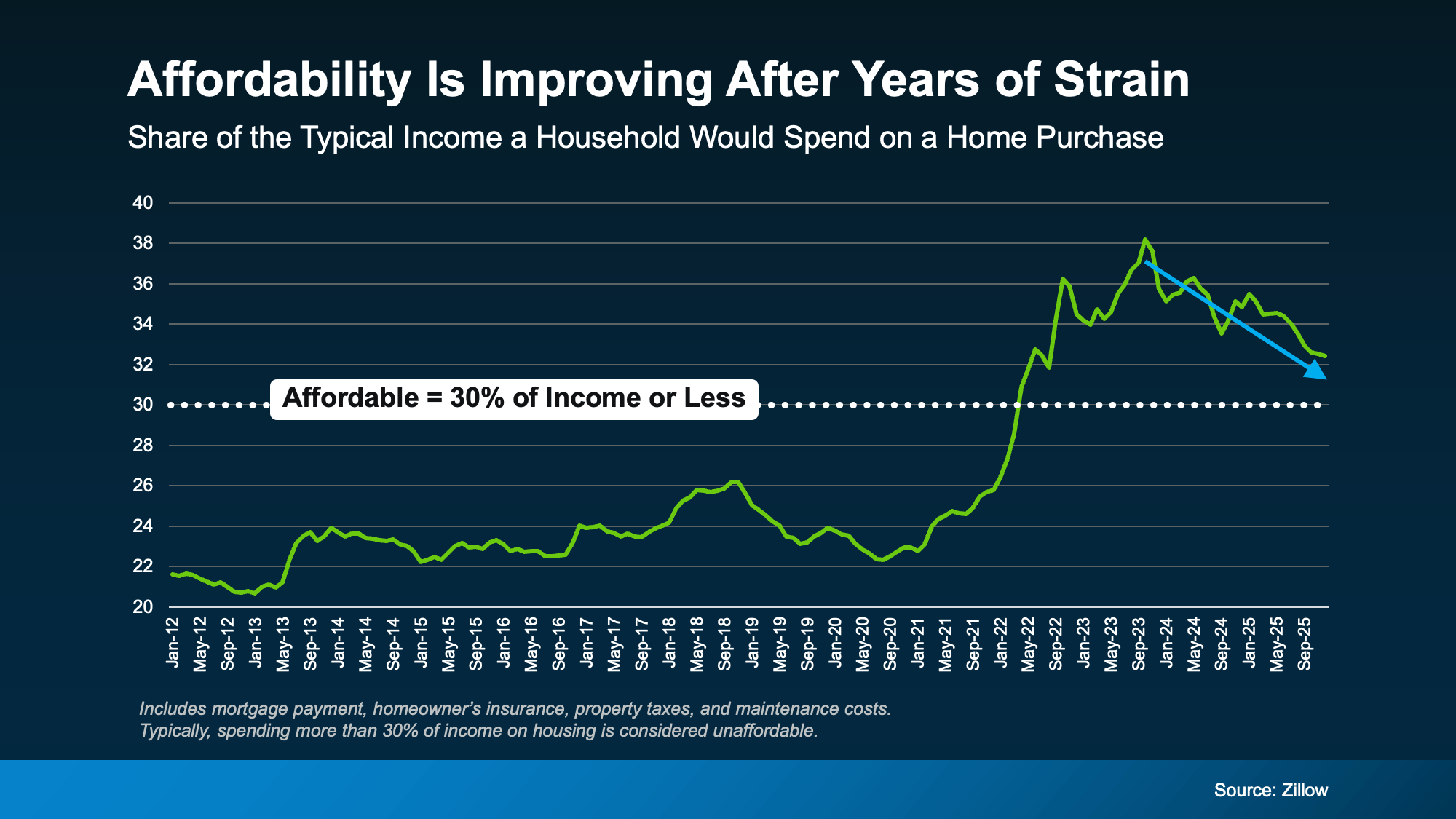

One of the best ways to see this shift is by looking at how much of a household’s income it takes to buy a home.

According to Zillow, housing is typically considered affordable when it takes 30% or less of your monthly income to cover your expenses. That includes your mortgage payment, taxes, insurance, and basic maintenance.

For the past few years, the math was well above that threshold, and it made buying a home unachievable for many. But now, we’re slowly moving back toward a balance. Zillow research shows it’s taking less of a typical household’s income to buy a home than it did just a few years ago (see graph below):

Now, we’re not all the way back to Zillow’s threshold of 30% of your income or less, so affordability is still tight. But things are trending in the right direction.

Now, we’re not all the way back to Zillow’s threshold of 30% of your income or less, so affordability is still tight. But things are trending in the right direction.

Why Affordability Is Improving

So, what’s driving the change? A lot of the focus lately has been on mortgage rates and how much they’ve come down over the course of the past year. But that’s not the only factor working in favor of buyers right now. Here are three trends benefiting buyers today:

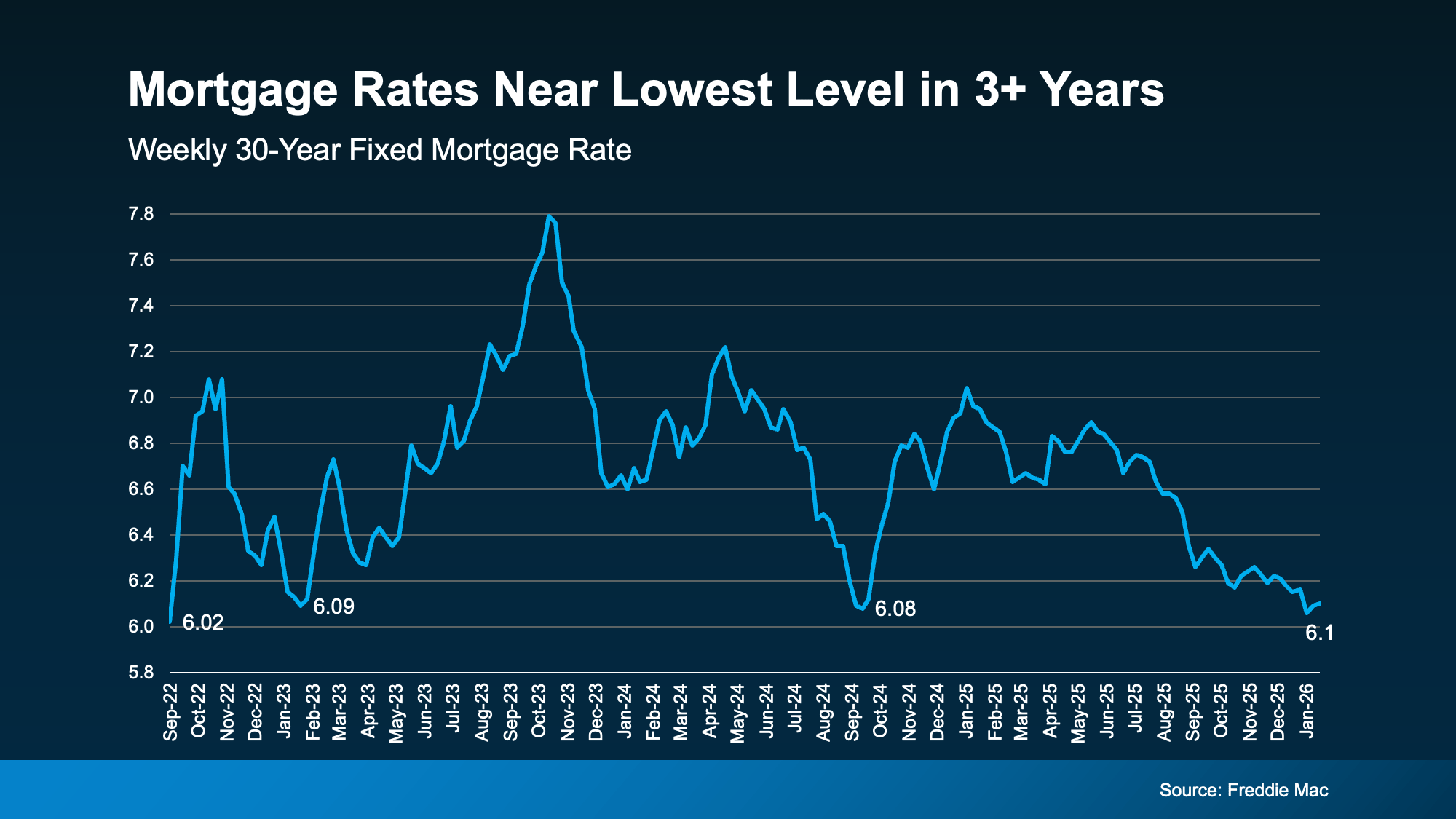

1. Mortgage rates have eased. Rates are near their lowest level in more than three years, which helps lower monthly payments (see graph below):

2. Home price growth has cooled. Prices aren’t falling nationally, but they’re growing much more slowly than they were a few years ago. That means buyers today aren’t facing the same sharp jumps in purchase prices, which helps keep monthly payments more manageable – and buying more predictable.

3. Wages are growing faster than home prices. This one matters a lot. As Mark Fleming, Chief Economist at First American, explains:

“When income growth exceeds house price growth, house-buying power improves—even if mortgage rates don’t decline meaningfully.”

None of this makes buying cheap, but it does explain why the math is starting to work a little better for buyers than it did even a just a year ago. Put simply, the forces that hurt affordability over the past few years are finally easing. Fleming again explains it well:

“Affordability remains challenging, but for the first time in several years, the underlying forces are finally aligned toward gradual improvement. Mortgage rates may drift down only slowly, but income growth exceeding house price appreciation will provide a boost to house-buying power — even in a higher-rate world. Affordability won’t snap back overnight, but like a ship finally catching a steady tailwind, it’s now sailing in the right direction.”

These three factors combined are why economists expect affordability to keep improving in 2026.

Where Homes Are Becoming Affordable First

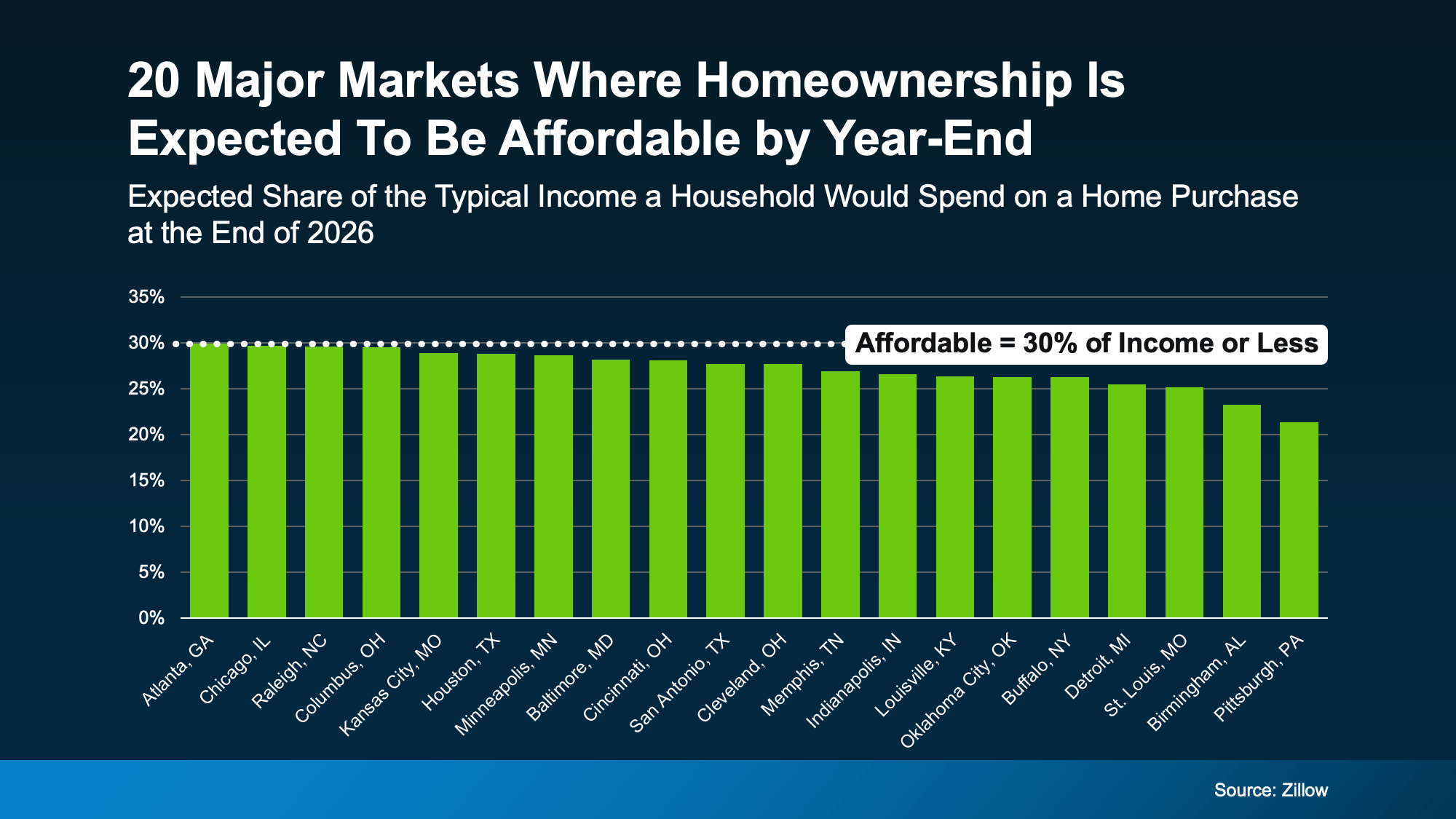

But how much is affordability really going to improve? In some places, noticeably. Zillow says some markets are expected to fall back under their affordability threshold (30% of your income or less) by the end of the year:

But that doesn’t mean you have to be in one of these markets or wait until year-end to buy. Other places are already seeing big improvements in affordability. So, talk to a local agent about what’s happening in your market. You may find you’re able to buy after all.

Bottom Line

For the first time in quite a whole, affordability is easing. That’s a meaningful shift.

And because this improvement isn’t happening everywhere at the same speed, understanding what’s changing locally is what really makes a difference. If you want to see how these trends show up in your area, talk with a local real estate agent.